Option contract price calculator

Call Option Calculator is used to calculating the total profit or loss for your call options. Customize your inputs or select a symbol.

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

The long call calculator will show you whether or not your options are at the money in the money or out.

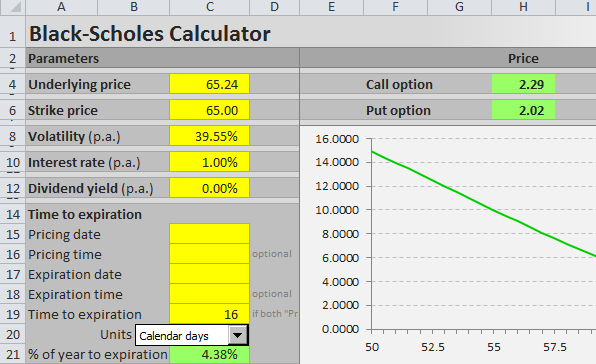

. For options the Greeks can be. Charted Price - the split between the bid and ask. The Option Calculator can be used to display the effects of changes in the inputs to the option pricing model.

This stock option calculator computes can compute up to eight contracts and one stock position which allows you to pretty much chart most of the stock options strategies. With SAMCO your brokerage will be Rs20 for the entire order. The inputs that can be adjusted are.

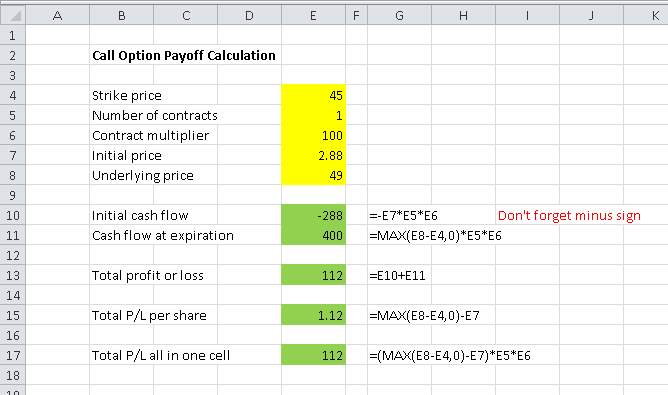

Investment are sold inside contracts or a lot of 100. Copies of this document may be obtained from your broker from any. Free connection to market data - automatically calculates historical volatility Calculate a multi-dimensional analysis The below calculator will calculate the fair market price the Greeks and.

Prior to buying or selling an option a person must receive a copy of Characteristics and Risks of Standardized Options. Your Free Options Prices calculator. The options calculator is an intuitive and easy-to-use tool for new and seasoned traders alike powered by Cboes All Access APIs.

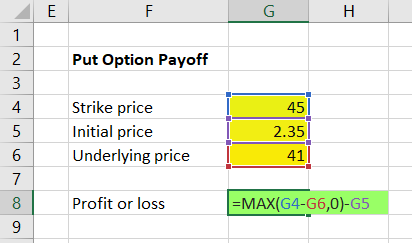

Options Calculator Spot Price Strike Price Day To Expiry Interest Volatility DivYield CALCULATE NOW What is Option Value Calculator. To put it simply say you buy 20 lots of call options on the NIFTY in one order. Options Calculator is used to calculate options profit or losses for your trades.

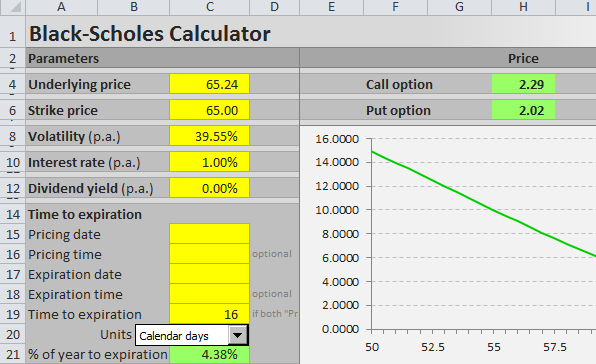

Generate fair value prices and Greeks for any of CME Groups options on futures contracts or price up a generic option with our universal calculator. The goal is to enter contracts that let you buy shares for cheaper than what they rise to be worth by the expiration date. Underlying Price 0 100000 Strike Price 0 100000 Volatility 0 250 Interest Rate 0 10 Dividend Yield 0 20 Days.

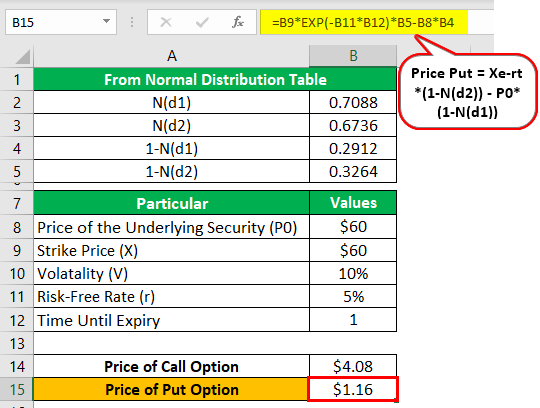

Option Pricing Models are mathematical models that use certain variables to calculate the theoretical value of an option. Customize your input parameters by strike. Calculate the future options prices.

Option value calculator Calculate your options value. With this input the stock options calculator will be able to display your exact return target return and. Example Youre presented with a call option to buy 100 shares in.

The option calculator uses a. Simply enter any brokerage fees you will have for buying or selling options contracts. Price Per Choice This is actually the price each a single stock option.

Options profit calculator will calculate how much you make and the total ROI with your option positions. You can calculate your savings with the Brokerage. Theoretical Price - price derived using the historical volatility of the underlying stock or index.

In other words the particular contract gives typically the option buyer. The theoretical value of an option is an estimate of.

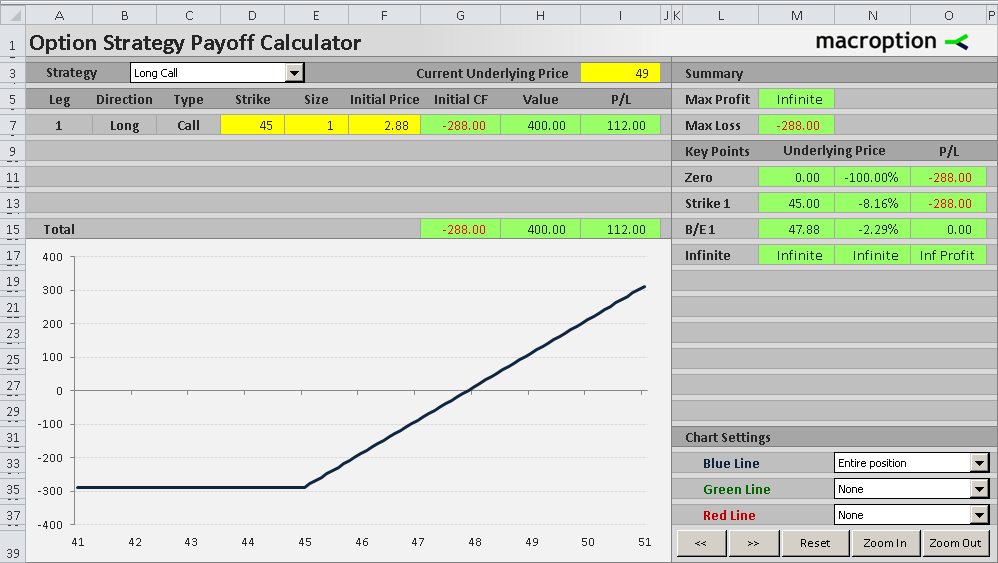

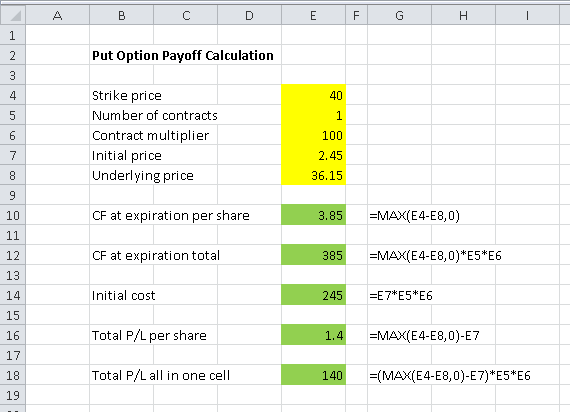

Calculating Call And Put Option Payoff In Excel Macroption

Call Option Payoff Diagram Formula And Logic Macroption

Calculating Call And Put Option Payoff In Excel Macroption

Call Option Payoff Diagram Formula And Logic Macroption

:max_bytes(150000):strip_icc()/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-04-3d62440d22b8498684ee7f7773b52c07.jpg)

Options Basics How To Pick The Right Strike Price

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

:max_bytes(150000):strip_icc()/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

Options Basics How To Pick The Right Strike Price

Options Strategy Payoff Calculator Excel Sheet

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

Put Option Payoff Diagram And Formula Macroption

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-02-ba51015e895b4ba7abbd7632e1908360.jpg)

Option Pricing Models Formula Calculation

Call Option Calculator Put Option

European Option Definition Examples Pricing Formula With Calculations

Options Profit Calculator Options Calculator

Black Scholes Excel Formulas And How To Create A Simple Option Pricing Spreadsheet Macroption

Pricing Options Strike Premium And Pricing Factors Nasdaq

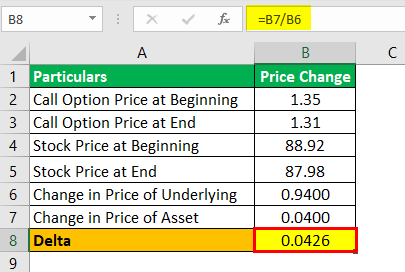

Delta Formula Definition Example Step By Step Guide To Calculate Delta